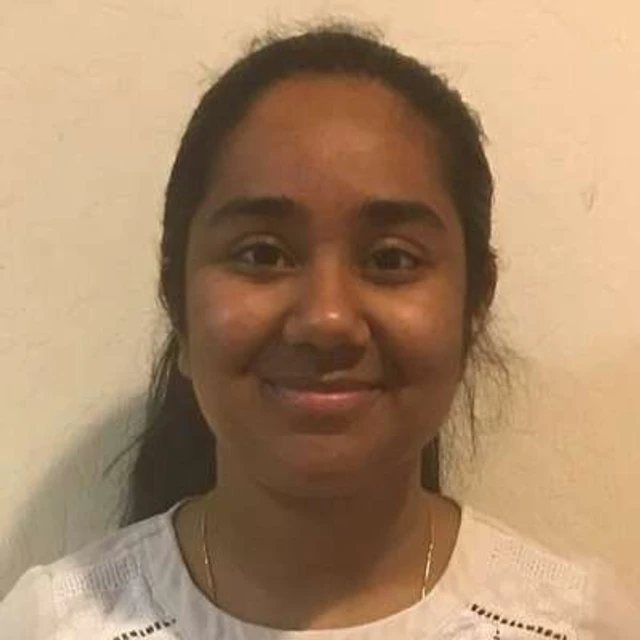

Susan

MA

Expertise

Literature, Creative Writing, Film, Folklore and Fairy Tale Studies, Editorial Work, Publishing, Mythology, Dystopian film and literature, Speculative fiction, Fantasy fiction, Magical Realism, Writing for Publication

Polygence mentors are selected based on their exceptional academic background, teaching experience, and unique ability to inspire the next generation of innovative thinkers and industry leaders.

Literature, Creative Writing, Film, Folklore and Fairy Tale Studies, Editorial Work, Publishing, Mythology, Dystopian film and literature, Speculative fiction, Fantasy fiction, Magical Realism, Writing for Publication

Medical Imaging, Medical Physics, Machine Learning, Medical Image Analysis/Processing, Artificial Intelligence

Drug discovery, microbial interactions, environmental microbiology, genome mining, bioengineering

Neuroscience, electrophysiology of the brain, digital signal processing, psychology, data science, coding, programming, neuroimaging, ethics, social science

Neuroendocrinology, Neuroscience, Reward and Motivation, Learning and Memory, Drugs, Psychopharmacolgy, Sex differences, Psychopathology, Development, Evolution

perception and computer vision for robotics, image processing, scene understanding

Technology Policy, Web Development, Cyberdefense/Cybersecurity, Election Security

Mechanical engineering, Electrochemistry (batteries, fuel cells, etc.)., Applied Mechanics, Energy Storage, Energy Policy, Materials Science

Pharmacy/healthcare-realted topics! (could be general medicine, healthcare, cancer etc.)

Materials Science | Materials Engineering | Physics | Optics & Diffraction | Electrochemistry | Polymer Science

digital art, web design, sound design, historical fashion, herpetology, fashion, art history, game development, app development

Master of Healthcare Administration. I also have a BS in Biology.

astronomy, astrophysics, cosmology, physics, planetary astronomy, stellar astronomy

Environmental Sciences (agriculture, plant biology, ecology, etc), Arts - dance or creative writing, Business Topics, and Sustainability of environmental, social, and economic topics. Solar energy development as well.